At first glance, many people assume renters insurance is only to protect their personal property. But did you know that renters insurance actually provides three types of coverage?

1. Personal Property or Personal Belongings Coverage:

This includes items such as furniture, clothing, electronics, appliances, and bedding to name a few. However, there are certain personal belongings that may not be covered if they are above a certain value. For items such as jewelry, artwork, and collectibles, one must usually add-on to their policy for additional coverage.

2. Renters Liability or Personal Liability Coverage:

Let’s say you are having a dinner party, one of your guests slips and falls in the kitchen putting you at fault and then sues you. General liability coverage may cover court costs and attorney fees that your renters insurance otherwise wouldn’t. Think of it this way: personal property coverage covers your belongings, personal liability insurance covers you!

3. Additional Living Expenses Coverage:

This coverage can provide the policy holder with reimbursement if a covered disaster results in temporary relocation from the property. Examples of reimbursement may include lodging, food, and other living expenses. While the policies may vary, covered disasters often include smoke, fire, explosions, theft, vandalism, windstorms, lightning, and water damage from an internal source.

4. Flood Insurance Policies/Coverage:

Generally speaking, renter’s insurance does not cover damage to your belongings in the event of a flood (this also applied to sewage overflows that enters the home). If you live in a flood zone, we highly recommend you review flood coverage with your insurance agent as part of your renters insurance. If you are unsure about whether or not you live in a flood zone, please refer to your lease agreement or check the FEMA flood map.

Final Thoughts:

It’s easy to fall into the mindset of “but that wouldn’t happen to me”, and chances are, it might not. However, it’s always better to be safe than sorry, especially in an event that is out of your control.

What is in your control?

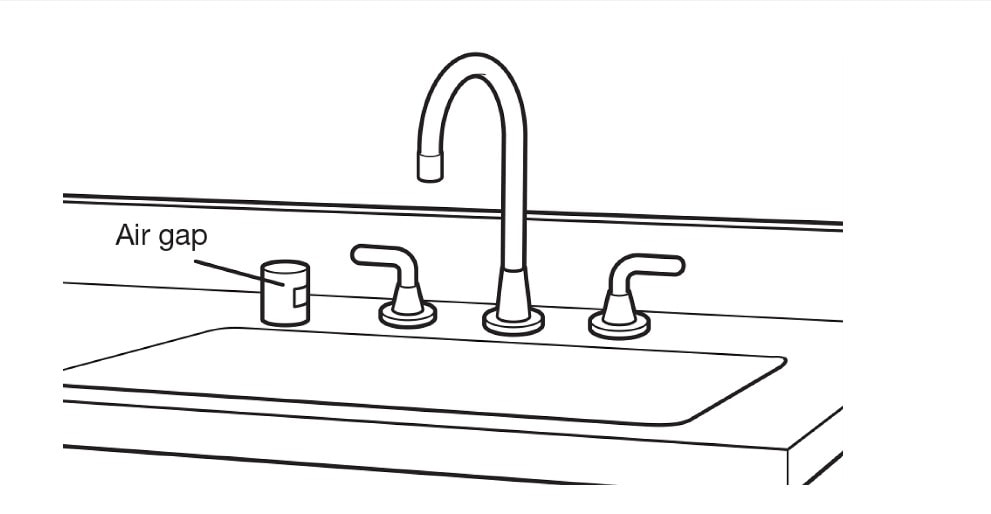

Regularly checking for leaks under you sink, at the base of your toilets and anywhere else where water can easily pool. It is absolutely crucial that any leaks or water damage is reported to your property manager AS SOON AS THEY ARE NOTICED! Failure to do so or negligence of the issue can cause irreversible damage the property that becomes the tenant’s responsibility. If these things are caught right away, further damage can be avoided. When in doubt, call and ask as soon as you notice!

As you may have gathered, there can be a lot of gray areas when it comes to what may or may not be covered depending on the company you choose to buy a policy with, and the policies themselves. It is always a good idea to review your options with your insurance broker to make sure you’re getting the coverage you desire.

Finally, if you haven’t done so already, please have your agent include Distinct Property Management as one of your certificate holders so we can be sure to have your policy on file.

Disclaimer: Distinct Property Management is not an insurance agent and can not advise what coverage is appropriate for you. Please consult your insurance agent.